Six Opportunities For New Business You Should Be Exploiting

Any entrepreneur looking for success knows that the key lies in being able to expand a business and a brand. If your business has hit a bit of a speed bump, that doesn’t mean it has grown to its full potential. It could mean, instead, that there are opportunities you haven’t yet taken advantage of. Below, we’ve compiled six of these opportunities that could show you there’s plenty of life in the old business yet.

Any entrepreneur looking for success knows that the key lies in being able to expand a business and a brand. If your business has hit a bit of a speed bump, that doesn’t mean it has grown to its full potential. It could mean, instead, that there are opportunities you haven’t yet taken advantage of. Below, we’ve compiled six of these opportunities that could show you there’s plenty of life in the old business yet.

1) Accepting different payment types

Something that every company should ask when they reach their zenith is what kind of customers they’re currently missing out. The answer almost always involves some sort of payment option that’s currently missing. If you’ve never given much thought to it, take a look at the various methods your customers are likely to use. Scout around and see if it’s worth investing in opening your business to more.

2) Going B2B

Another opportunity that doesn’t cross quite as many people’s minds is the possibility of going business to business. Set the focus on consumers aside and consider the benefits of marketing to other businesses. For one, businesses tend to value loyalty and reliability. If you successfully keep their custom once, you’re more likely to keep hold of them.

3) Mobile business

If you’re running an online company, you may need to take another look at how your services and store look online. You may have a site you optimised so perfect for presenting your site on a personal computer. The chances are it doesn’t fit quite as you would want it on mobiles. Your customers will notice this too. Developing an app or mobile site with the help of web design firms could stop them from visiting the more optimised sites of your competitors.

4) The business event

If your clients are the kind to pay close attention and learn as much as they can about your services, this could be ticket. When properly marketed, it presents an opportunity for people to get to know your business in detail without making a commitment. It’s a great way to add a human face and some energy to your sales process, too. On top of that, they work just as well for networking with other businesses.

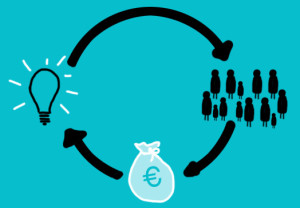

5) Funding platforms

If you’re looking to expand your business, you may not always have to try scrape as much as you can from your business. You don’t even have to go to traditional investment options. There are a lot of alternative funding platforms available nowadays, so check them out.

6) Selling your expertise

One great way to build your personal brand at the same time as bringing attention to your business is by selling your knowledge. This is primarily done through paid speaking opportunities. You can find a lot of these about, that give your chance to establish yourself as an expert in your field. For an entrepreneur, the profile does a lot of good for both you and your business. Providing you can sell yourself well enough.