The Habits Of New Forex Traders Who Make Money

These days it seems everybody wants to be a trader. Despite the financial crash and all of the negative press, trading on the international markets is still trendy.

These days it seems everybody wants to be a trader. Despite the financial crash and all of the negative press, trading on the international markets is still trendy.

What’s more, because interest rates are so low, it’s not just regular stock brokers and traders tradings on the forex. Now there are hordes of amateurs looking to make a return on their savings and get in on the action.

The problem however, is that very few of these amateurs know what they’re doing. They’re not following the bet trading practices out there, often because they’ve jumped in too soon. If you decide to start trading, make sure that you do the following.

They Practice Using A Demo Account

Starting a demo account and trialling out forex might seem like a no-brainer. But thousands of people start trading with real money from the get-go, without ever having put in any practice.

Demo accounts will give you an idea of whether the forex is for you. You’ll be able to play about with different financial instruments, like binary options low deposit options and so on. And you’ll eventually get a sense of whether the forex market is a market in which you want to spend time trading. If you like sitting eagerly at your computer all day following the markets, it could be for you. If you’d rather be doing something else, or the thrill just isn’t there for you, you can learn that lesson without having blown any of your money.

They Do Their Research

All investors know that their job is fundamentally about the flow of information. After all, if all information were known, then prices from now until forever would be known too. The real world is, of course, full of uncertainty. But if you can gain insights using historical data or the latest trends, you may be able to predict future price trends. And predicting future price trends is what it’s all about in the foreign exchange markets.

Short term trading tends to depend more on the sentiment of investors in any given moment. If you expect the sentiment towards a currency that you own will soon worsen, sell now and buy it back when the price has fallen.

Underlying fundamentals tend to affect the value of currencies in the long term. So if you’re a long-term investor, you’ll always be on the lookout for political and institutional factors that might adjust prices.

They Don’t Bet All Their Cash At Once

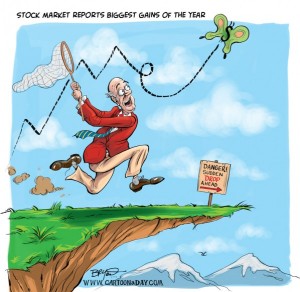

Most investors have portfolios outside of the forex. That’s because the market is notoriously volatile. Yes, there are dizzying highs. But there are also devastating lows.

It’s important to limit your losses by only using about 2% of your funds per trade and incorporating a stop-loss order on your account. Taken together, this will reduce the amount of money that you can lose and afford you sufficient capital to cover your downside.

Remember, you only lose money on a trade when you decide to sell, so having enough capital in the interim is essential to keep your position open.